Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Saturday, December 30, 2023

Those Santa Rally Signals Now Flipped On Their Heads (video)

Thursday, December 28, 2023

PWA 2023 Year-End Letter, Part 6: What's Next?

Wednesday, December 27, 2023

PWA 2023 Year-End Letter, Part 5: More On the Current Cycle

"...if we apply some insight regarding cycles, we can increase our bets and place them on more aggressive investments when the odds are in our favor, and we can take money off the table and increase our defensiveness when the odds are against us." --Marks, Howard

What I'll call my broken-record line of the past several months has been:

"While you and I may or may not appreciate the world we'll be living in during the next cycle, it'll be rich with macro investment opportunities, once we're through whatever's left in the current cycle."

So let's break that down:

My implication that there's more to play out before we can declare coast is clear to allocate for the early-cycle phase of what's to come stems from, frankly, 39 years of intimacy with the economy and with global markets.

Friday, December 22, 2023

PWA 2023 Year-End Letter, Part 4: The Dollar

"The reports of my death are greatly exaggerated."

--The US Dollar

Among the factors that influence the asset mix of a thoughtfully designed global macro portfolio, the manager’s long-term dollar thesis is key.

Wednesday, December 20, 2023

Late Cycle Environment

Numera Analytics just published their year-end macro strategist commentary... If you've been keeping up with our year-end message to this point -- Part 2 and the recent video update, where we delved into yield curve dynamics, in particular -- the following from the aforementioned commentary will ring very familiar.

I.e., while we're not consensus right here (which, frankly, only emboldens our conviction), per the below, we're not the only ones seeing what we see:

Tuesday, December 19, 2023

Market Update: Major Indices, Nvidia, Yields, the Dollar and Sentiment (video)

Dear Clients, here's another one to be sure to take in...

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Thursday, December 14, 2023

Fed Surprise, Recession Outlook Update, And a Look at Markets and the Yield Curve (video)

Attention clients, this is an important one to take in, start to finish 😎.

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Tuesday, December 12, 2023

Market Snapshot: What a Greedy Setup Looks Like, & an Update on Stocks, Yields, the Dollar and Gold (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

PWA 2023 Year-End Letter, Part 3: Mitigating Risk, While Capturing Some Upside

In last year's year-end message we expressed the following go-forward view of equity market conditions:

"As for our present view of conditions, while we don't believe we're out of the icy water just yet -- and, for the moment, we anticipate that'll it'll get even colder before things begin to warm up -- we indeed see bluer skies on the not-too-distant horizon... Although, as you'll read in the remainder of this year-end message, we think the skating will be far better on ponds the vast majority of investors neglected during the previous bull run."

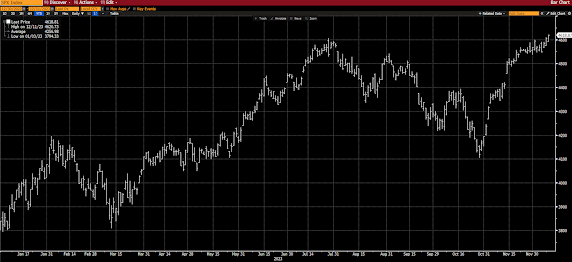

Here's the S&P 500 year-to-date:

Sunday, December 10, 2023

PWA 2023 Year-End Letter, Part 2: The Economy and the Stock Market

Thursday, December 7, 2023

Market Update: Seasonality vs The Technicals, plus Yields, The Dollar and Gold (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Wednesday, December 6, 2023

PWA 2023 Year-End Letter, Part 1: If A Blizzard Hits, Characteristics of The Best Portfolio Managers, and An Invaluable, Timely, Quote-Fest

As you (clients) know, I enjoy using analogies to explain our view of market and economic general conditions... In the past I've associated our macro analysis with the flight path of an eagle affixed with electrodes, etc., that allow us to monitor its vital functions as it glides across blue skies, sores to high altitudes, and flaps its way through the storms that occasionally cross its path.

Fishing, basketball and ice skating have also inspired some storytelling that has helped me drive home how we approach the task of preserving, protecting and growing our clients' wealth in a manner that has them satisfying their objectives while, ideally, feeling comfortable amid the inevitable ups and downs delivered by world markets.

Monday, December 4, 2023

Morning Note: Equity Market Conditions Remain Challenged

Here's the intro to our internal monthly equity market conditions analysis, including our technical view of the current US dollar setup:

11/30/2023 PWA EQUITY MARKET CONDITIONS INDEX (EMCI): -41.67 (-16.67 from 10/31/2023)

SP500 Index November 2023, +8.92%:

SP500 Equal Weight Index November 2023, +8.87%:

November turned out to be the best month of 2023.

While the EMCI score was still net negative, it had risen an unusually large 33 points by the star of the month.

Saturday, December 2, 2023

Economic Update: Classic Late Cycle, Copper & China, Bullish Sector Signal, Stocks, Sentiment, Gold (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Friday, December 1, 2023

Novembers Past, Santa Headwinds, yada yada (video)

The following quote (and video), along with our own models, speaks to our stubbornness around remaining hedged right here:

"Stock investors should hope for the best but prepare for the worst when it comes to gauging the outlook of the US economy. Soft-landing optimists have a case to make, yet the historical evidence is overwhelmingly bearish when it comes to the end of previous Fed hiking cycles. Equities face steep losses if the economy sees a “softish” or hard landing.

In the 11 times when the Fed has tightened monetary policy to combat inflation since 1965, stocks escaped largely unscathed only about three times. The other occurrences saw average peak-to-trough losses of nearly 30% in the years after interest rates peaked."

-- Tatiana Darie (Bloomberg)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Thursday, November 30, 2023

Morning Note: Pricing Power and the Price of Labor

FYI, for the next few weeks (to year end), I'll be a bit less active, and less voluminous, here on the blog, as I'll be devoting the time normally spent organizing, then articulating, my thoughts for the daily message to what, as usual, will be a several part year-end message (delivered over the final two weeks of the year)..

So, for this morning, just the following graph (H/T BCA Research), followed by my brief assessment, and some critical investment wisdom from the late great Charlie Munger:

Wednesday, November 29, 2023

What Election Year Stimulus Portends, And Not a Great Short Term Look From Yields & the Dollar (video)

Bloomberg's Cameron Crise this morning speaks to what has stocks green at the open:

"When you are a bull, everything looks like a red cape, which kind of explains how the market is likely to interpret this morning’s data. The salient features were a downward revision to the Q3 core inflation index, a downward revision to last quarter’s household spending, and downside surprises to October inventory data (which should produce a downgrade to current-quarter growth estimates.) That all casts a dovish hue on the policy backdrop..."

All of which denotes a slowing economy, which of course is to be expected if the 2024 recession narrative is to play out... In the meantime, as is typical at this stage, confirmation of such, is, ironically, bullish for stocks.

Tuesday, November 28, 2023

New Sherriff In Town!

Monday, November 27, 2023

Morning Note: Simply Can't Ignore Breadth, Your Weekly Sector, Region and Asset Class Update, and Into Thin Air

Yes, we've touched on this plenty of late, but, again, per our weekly results update below, the divergence among equity sectors this year has been utterly shocking... And while indeed a serious broadening (the 8 of 11 sectors that are, let's say, not having a magnificent year playing catch up) may be in the offing, history offers up some serious red flags to consider.

Allow me to illustrate.

Friday, November 24, 2023

Economic Update: Good and Bad Earnings Commentary, A Stressed Macro Backdrop and a Quick Look at Stocks and Sentiment (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Wednesday, November 22, 2023

Quote of the Day: Wall Street "Running With No Protection"

Comments made by Hedgeye CEO Keith McCullough in today's Macro Show resonated with me, and has me calling up the following from my video commentary this morning:

"Let's see this for what it is; this is not a time, from these levels and from this stage in the cycle, to expect that the next new raging bull market is about to begin...

The "Cult 6", a Moment in Time, Cisco Then/Nvidia Now (video)

Toward the end where I mention jobless claims, I suggested that a weak number would be bullish for stocks (given the present character of the trading), I actually meant that a strong number (denoting a weak labor market) would be bullish... Now, go figure, the number was weaker than expected (denoting a strong labor market) and equity futures didn’t budge... Although, I should add that last week’s number was revised up (weak sign), and Nvidia didn’t whiff yesterday... Hmm...

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Tuesday, November 21, 2023

Morning Note: A Hugely-Important Quote, and Key Highlights From Our Latest Messaging

Monday, November 20, 2023

Morning Note: Sector, Region and Asset Class Results Update

This, from Howard Marks, captures the messaging herein of late:

"...you’re unlikely to succeed for long if you haven’t dealt explicitly with risk. The first step consists of understanding it. The second step is recognizing when it’s high. The critical final step is controlling it."

Saturday, November 18, 2023

Quote of the Day: Human Nature "Doesn't Change"

Friday, November 17, 2023

The Economy is STILL Cyclical, and How To Think About Corporate Profits Going Forward (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

The Near-Term Bullish Case, What Say TGT, WMT and CSCO, and Nvidia's Setup (video)

In this morning's video (recorded yesterday) I mention Walmart's outlook on the consumer... To really pound home their expectations; this from the CEO:

"We may be managing through a period of deflation in the months to come."

I can not stress enough what such a scenario would do to corporate earnings, particularly this go-round.

Thursday, November 16, 2023

Quotes of the Day

Premium research provider Numera Analytics, like us, sees late cycle dynamics at play, and is, thus, cautious on equities right here... They, also, per their just-released Global Asset Allocation Report, nevertheless see opportunity in certain emerging markets:

Morning Note: Looking Forward

Amidst our constant reminders that the present equity market setup remains somewhat precarious, we also continue to hint that our go-forward thesis sees unique global opportunities ahead -- beyond, that is, what's left in the current cycle.

Crescat's Tavi Costa points to one that we agree makes great sense going forward:

Yes, resource-rich economies, both from a valuation standpoint and given our view on the dollar during the next cycle, are one of those opportunities... Whether or not now's the time to take on full positions, well, that remains to be seen.

Wednesday, November 15, 2023

Underneath Tuesday's Rally, the Importance of Yields & the Dollar, and From These Valuations (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Tuesday, November 14, 2023

Morning Note: The Woods

This morning's CPI report comports perfectly with our current and go-forward theses... Current being the market reaction (up) to a weaker than expected print, the go-forward being that weaker inflation is 100% consistent with a weakening economy... The market reaction also, as I've been pointing out in the video commentaries, comports on balance with the short-term technical setup for equities, yields and the dollar.

Monday, November 13, 2023

Morning Note: Sector, Region and Asset Class Results Update

Not much to add this morning to Friday and Saturday's video commentaries... CPI tomorrow, retail sales Wednesday, earnings announcements, Fed speakers, and, alas, the government shutdown circus I suspect will give us plenty to comment on over the next few days.

Here's your weekly sector, region and asset class results update (and a quote to ponder):

Saturday, November 11, 2023

Labor Mkt Red Flags, Sector Signal, and a Quick Look at the Setup for Stocks (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Friday, November 10, 2023

Investor Sentiment vs Consumer Sentiment, and Not the Time if Your Time Horizon Exceeds 2 Months (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Thursday, November 9, 2023

Morning Note: The Joneses, Fleeting Breather(s), and the Tricky Part

Diane Swonk is a very good, thoughtful, objective economist... This morning's message is all her:

"One lesson I learned early in my career was that consumers will resist, with everything in their power, reductions in their standard of living. Later I learned that it was not just the amount people accumulated that mattered, but the pace at which they accumulated stuff that became so entrenched. A version of keeping up with the Joneses played out en masse.

Wednesday, November 8, 2023

Consumer Credit Concerns, Stocks, Yields, the Dollar, yada yada (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Tuesday, November 7, 2023

Morning Note: Opportunity looms, if, that is....... And a Quote to Ponder

Monday, November 6, 2023

Morning Note: Cat's Signal, Investor Denial, and Your Weekly Sector, Region and Asset Class Update

Here are the highlights from Bloomberg's Tatiana Darie's warning about the signal in Caterpillar's latest numbers (which [Cat's global sales growth], btw, happens to be one of the 47 inputs to our PWA Index).

Emphasis mine:

Caterpillar Is Sending a Warning About the Economy: Macro View (Bloomberg) -- Caterpillar earnings spooked investors, who saw a drop in its order backlog as an ominous sign for the global economy. At least for the US, its largest market, that holds some truth, which means it’s also a warning for the stock market.

Saturday, November 4, 2023

Economic Update: A Tale of Two Consumers and A Bit More on Stocks, Smallcaps in Particular (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Friday, November 3, 2023

Special Report: Equity Market Conditions Update

Concerts, Child Care, YOLO, Yen, the Dollar and a Rally Right on Cue (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Thursday, November 2, 2023

Morning Note: Another Bull Trap, Maybe? And Two Must-Read Quotes

In yesterday's chart of the day, I illustrated the point that, at this juncture, weak economic news is strong stock market news... I think I've expounded sufficiently as to why in our latest commentaries... The other thing the equity market has going for it is resoundingly sour sentiment, all of a sudden.

The setup is pretty similar to what we sniffed out at the beginning of October.

Wednesday, November 1, 2023

Chart of the Day: Yep, Bad News is (for the moment) Good News

As clients and regular readers have no doubt noted, while the next leg of the current bear market (should there be one) will be characterized by declining corporate earnings amid notably weakening economic conditions, in our view the latter, in its early stages, will, ironically, very likely inspire a potentially not-small rally in stocks.

In today's chart of the S&P 500 below, I green X'd the moment the ISM Manufacturing Survey for October was released, and two spots during Fed Chair Powell's press conference:

As for the ISM survey, expectations had it coming in at 49, which just barely denotes contraction... The actual reading, however, was a surprisingly low 46.7, sending it (the manufacturing sector) deeper into recession territory...

And, lo and behold, stocks immediately popped higher on the release -- validating our latest messaging herein.

As for that volatility around Powell's presser, when he came out of the gate with some tough talk on remaining vigilant, stocks bolted lower -- the market is desperate for the Fed to lighten up (not considering the conditions [and the earnings setup] that will actually make that happen) -- he then proceeded to celebrate the progress they've made thus far 😕, and to essentially not say anything to further upset the market applecart right here.

As I've pointed out in the last 3 video updates, the technicals were also pointing to pretty strong odds of a rally right here.

Stay tuned...

Stinky Breadth, What Small Caps Say, When We'll Buy Them, and Staying in the Foothills For Now (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Tuesday, October 31, 2023

Morning Note: Key Highlights and The Ills of Intervention

Key highlights from our latest messaging:

Yesterday:...according to the technicals, odds favor a near-term rally in equities, according to the fundamentals, continued caution is very warranted.

Monday, October 30, 2023

Morning Note: Sector, Region and Asset Class Results Update

Our last 2 video commentaries pretty well cover our view of the short and long-term scheme of things... I.e., according to the technicals, odds favor a near-term rally in equities, according to the fundamentals, continued caution is very warranted.

In case you missed them:

Technicals Point To A Near-Term Rally, But, Ultimately.....

Sunday, October 29, 2023

The Consumer, Market Signals, Earnings Call Insights and Yes, We're "Late in the Game" (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Friday, October 27, 2023

Technicals Point To A Near-Term Rally, But, Ultimately....... (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Thursday, October 26, 2023

Morning Note: Ambiguity Remains

While Q3 GDP came in better than expectations, its underlying inflation gauge came in softer than expected... Combine the latter with higher than anticipated weekly unemployment claims (particularly continuing claims, as I highlighted in last Friday's economic update), and a clearly dovish ECB monetary policy statement, and you get a knee jerk market reaction which entirely comports with our short-term view (bad economic news = short-term good news for stocks).

Here's SP500 futures action so far this morning -- it's presently10 minutes before the open (the green arrow points to the moment the GDP and jobless claims numbers were released):

Wednesday, October 25, 2023

Magnificence Questioned, AI Angst, Stocks, Yields, the Dollar, What's Inspiring Gold, and What Good Investors Do (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Tuesday, October 24, 2023

Morning Note: Beyond the Time Being

Ackman tweeted his comments at 6:45am.

Monday, October 23, 2023

Morning Note: Not So Fast On That New Bull Market Call, And Your Weekly Sector, Region and Asset Class Results Update

If you've been tracking our weekly results updates you've noticed, of late, a growing shade of red... As we've maintained since the October '22 bottom, macro dynamics have remained such that a next leg down carries odds too high to ignore.

Now, many on Wall Street have taken the stance that the bear market is over and done, and that a new bull market is just getting underway.

Friday, October 20, 2023

Economic Update: Housing, Jobs and The Yield Curve (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Quite A Bit Yet To Play Out, and a Look at Stocks, Yields, Gold & the Dollar (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Thursday, October 19, 2023

Morning Note: Suddenly, A Little Demand for Long-Term Treasuries

Just a quick note this morning; anything more from me today would be simply redundant.. I.e., not much more to report beyond our latest written and video messaging... Not much, that is, other than yesterday's 20-year treasury bond auction, which came as quite the surprise to the market, and, given the messes that were last week's auctions (mentioned in Friday's important video update), to yours truly as well.

Tuesday, October 17, 2023

Interesting Action Across Asset Classes (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Morning Note: The AI Hype Problem, And Surprising Retail Sales

Two points I'd like to make in the opening to this morning's message:

1. I am indeed in the camp that believes AI is a real long-term game-changer.

2. Like I said yesterday, "... today's CEO has been reduced to little more than shepherd of his/her company's stock price (quoting Julian Brigden)"

Now, with regard to my view of AI, the operative words there are "long-term." In the short-term, however, per last Monday's Wall Street Journal, there are issues that those Q2 earnings calls conveniently failed to mention (or at least emphasize).

Monday, October 16, 2023

Morning Note: That Ultimate Inflection Point, and Your Weekly Results Update

So, Q4 of the year is known for its friendliness toward the stock market... And, from a sentiment and Fed-speak standpoint, one could argue that -- geopolitical turmoil aside -- the 2023 Q4 setup isn't all that bad... I certainly don't think that Q3 earnings results, by themselves, will pose a challenge to the near-term bullish narrative.

Friday, October 13, 2023

Economic Update: Will Folks Keep Paying Twenty Bucks For a Breakfast Burrito? (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Gotta Get the $ Right, Beware the Outlooks, And a Check On Stocks, Treasuries, Gold, USD Technicals (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Thursday, October 12, 2023

Morning Note: Inflation, Fed (for the moment) Calming Waters, and Key Highlights

Wednesday, October 11, 2023

Constructive Technicals, But There's This Fundamental Problem (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Tuesday, October 10, 2023

Morning Note: Careful With That Conviction

On our strategy call yesterday morning, while I traveled between offices, we noticed the abrupt intraday turnaround (akin to last Friday's) in the equity market... My comment, without looking, was that it virtually had to be someone at the Fed saying something soft about go-forward monetary policy.

Sure enough, the typically-hawkish (higher rates advocate) Fed Vice Chair Phillip Jefferson essentially turned the tide with:

Monday, October 9, 2023

Morning Note: Sector, Region and Asset Class Results Update

Goes without saying, there’s much to unfold in the days ahead related to tragic weekend events… The uncertainty will reflect across asset classes, oil and “safe havens” in particular.

Stay tuned.

Here’s your weekly sector, region and asset class results update:

Friday, October 6, 2023

Economic Update, and Explaining Today's Rally (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Some History, and What the Future Setup Has In Store (video)

As you'll gather from this morning's video commentary (recorded last evening), yours truly was anticipating a "soft" jobs number this morning, and, as bad news is, for the moment, good news, a rallying stock market to go with it.

Well, scratch that! The number came in literally double the consensus estimate, and an astounding 100k above the most aggressive upside prediction... And, to top it off, the prior 2 months were revised up by 119k.

Now, that said, there was some softness that, when "the market" digests it, just might mitigate a bit of the premarket selloff we're seeing across equities and bonds... That softness came in what matters most in terms of inflation, average hourly earnings... They were up 0.2% month-on-month; consensus estimate had it at 0.3%.

Interestingly, gold is up .16% (silver's up 1.4%) premarket, despite a notable jump in real yields -- perhaps precious metals traders are already sniffing out that "softness" (although the morning's very young).

Anyways, here's your end of week market analysis... In this one I take you way beyond the latest action... We'll tour the past few market cycles, what worked, what didn't, and I scratch the surface on how one money manger (us) is presently addressing near-term dynamics, and what we're anticipating beyond the present cycle.

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Thursday, October 5, 2023

Morning Note: Bad News is (only for now) Good News, No Need For Another Hike, and A Rally Right Here Would Not Be One (for the prudent investor) to Chase!

This from Investopedia on yesterday's equity market action speaks to our latest messaging (video commentaries in particular):

"Index Rises as Hiring Slowdown Eases Fed Rate Hike Worries"

Yes, "hiring slowdown" is consistent with economic slowdown, and, yes, "the market" is obsessively focused on the Fed, as if the thing that ultimately matters most, corporate profits, does not in fact matter.

In our view, another rate hike is highly unlikely, as it is highly unnecessary, given that leading indicators are signaling uncomfortable odds of recession (and, thus, falling inflation) in the months to come.

Among our recent video commentaries, this one from September 15th is a must-watch (at least from the 4:00 to 14:20 mark) for those interested in a historical perspective on why -- despite what current trading action might otherwise portend -- an inflation-slaying economic slowdown will be problematic for stocks, even while the Fed is cutting rates in response:

Wednesday, October 4, 2023

Key Near-Term Support Level Approaching, and a few other things to consider (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Tuesday, October 3, 2023

Morning Note: Jaw Dropping Divergences, and Your Weekly Asset Class, Etc. Results Update (and a must-read quote)

Monday, October 2, 2023

Morning Note: A Still-Difficult Equity Market Setup

Here's the intro to our latest (internal) equity market conditions report:

9/30/2023 PWA EQUITY MARKET CONDITIONS INDEX (EMCI): -58.33 (+8.34 from 8/31/2023)

SP500 Index September 2023 Result, -4.87%:

SP500 Equal Weight Index September 2023 Result, -5.26%:

Consistent with EMCI’s latest scoring, September proved to be the worst month of 2023 for US equities.

Saturday, September 30, 2023

Weekly Economic Update (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Friday, September 29, 2023

Soft Is Short Term Good, The Boats Are Docked, And What If It's All About Oil? (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Thursday, September 28, 2023

Key Highlights

Here are a few key highlights from our recent messaging herein:

This Tuesday:

"...another way to view the present setup would be to recognize that -- while stocks look [to perhaps put it mildly] expensive -- bonds are beginning to look pretty (historically-speaking) cheap. Hence, my comment that, while it may still be a bit early, we'll definitely be eyeballing duration going forward."

Wednesday, September 27, 2023

Be Very Very Patient Right Here (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Tuesday, September 26, 2023

Morning Note: Eyeballing Duration

In last week's video update I suggested that we're keeping a very close eye on "duration," implying that assets that respond most-positively to falling rates have our attention, although we’re not yet adding to any, right here...

Monday, September 25, 2023

Morning Note: Sector, Region and Asset Class Results Update

Here's your weekly sector, region and asset class results update:

Saturday, September 23, 2023

Economic Update: Housing Starts Down, Permits Up, Builders Fretting, and Some Other Stuff (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Friday, September 22, 2023

What's Driving Markets Now, What Will Going Forward, What Volume Says, Yield Action, yada yada (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Thursday, September 21, 2023

Morning Note: Messy Setup

Call it, per Bloomberg's Michael McKee, "a unanimous hawkish pause." Yep, no rate hike at yesterday's Fed meeting, but threats of one by year-end, and projections that show monetary policy staying yet tighter for longer than they thought last time they told us what they thought.

Wednesday, September 20, 2023

Mid-Week Market Update: Few Boats Catching All the Fish (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Tuesday, September 19, 2023

Morning Note: What You Know About Nature

Monday, September 18, 2023

Morning Note: Sector, Region and Asset Class Results Update

For this morning's message we'll start by reposting Friday and Saturday's video commentaries... Both of these are we think very timely and should be viewed by anyone who’s at all interested in the current risk/reward setup for markets, and in what the latest consumer data say about the present stage of the economic cycle:

Saturday, September 16, 2023

Economic Update: Let's Talk About the Consumer (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Friday, September 15, 2023

The Big Question: How Will Stocks Handle the Next Recession? (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Thursday, September 14, 2023

Morning Note: Second-Level Pavlov

Here's the opening to a post I penned back on April 20, 2020:

"Keynes suggested circa a century ago that trading (as opposed to, I'll say, investing in) markets is not about assessing fundamentals, it's about what traders think other traders are going to do. And for the more savvy traders, it's about what they think other traders think other traders are going to do."

Wednesday, September 13, 2023

Stocks, Treasuries, Dollar and Inflation Snapshot (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Tuesday, September 12, 2023

Morning Note: Key (important) Highlights

A few key highlights from our latest messaging herein:

The signs for the global economy sent out by the "first mover" among the economic indicators - the sentix economic index - point to a further downturn and a strengthening of the economic downturn forces. The situation in Germany remains particularly precarious. Here we are measuring the weakest situation values since July 2020, when the economy was slowed by the first Corona lockdown. Germany is also weighing heavily on the economy in the euro zone as a whole. The recession is progressing.

But even for the USA, which has so far held up well and defied the restrictive FED policy, the economic data are falling markedly. The tipping point of a global recession is less distant than one might think.

Monday, September 11, 2023

Morning Note: Important Stuff!

Clients, if you haven't taken in Friday's video commentary yet, please do... I think it does a nice job describing a few of the drivers of our present assessment and overall allocation... I'll include the player at the very bottom of this note.

The following from the widely followed/highly respected Sentix September Economic Report comports with our current view of overall general conditions:

Friday, September 8, 2023

Economic Update: Autos, Inflation, Oil, the Dollar, etc (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Thursday, September 7, 2023

Morning Note: Unwittingly -- And -- Eerily Familiar

9/6/2023

Today’s action in US equities screams to the still-prevailing “soft-landing” market mood… I.e., bad news is viewed as good news, because, presumably, any weakness will not land us in recession, and (or perhaps because) it’ll inspire the Fed to ease policy.

So, when this morning’s ISM Services Survey came in better than expected, stocks immediately sold off (red circle below):

Wednesday, September 6, 2023

Morning Note: "Yield is Destiny"

As we've been pointing out during client portfolio review meetings of late, beyond whatever's left in the current cycle (our view is that odds lean toward another round of turbulence along the way), we see a number of what we believe to be very exploitable themes.

Tuesday, September 5, 2023

Morning Note: Equity Mkt Conditions Presently Unconstructive

8/31/2023 PWA EQUITY MARKET CONDITIONS INDEX (EMCI): -66.67 (-25.00 from 7/31/2023)

SP500 past 30 days, -1.77%:

SP500 Equal Weight Index past 30 days, -3.37%:

While stocks staged an impressive move over the final few days of August, the SP500 was unable to squeeze out positive results for the month… Breadth deteriorated notably, as evidenced by significantly worse results for the SP500 Equal Weight Index, as well as by the other metrics scored herein.

Friday, September 1, 2023

Economic Update: Jobs, Consumption, Caveats and a Quick Look at Stocks (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust: